Hence, registration for commercial land is also more than that of residential. Table of fees (prepared under section 78 of the indian registration act, 1908 (xvi of 1908).

Apartment Registration Charges, Most of the states have 1% as registration charges. Apart from this stamp duty on property, you need to pay registration charges, which are usually levied by the central government and are mostly fixed across the state.

Hi prajwal, the stamp duty and registration charges will be levied according to the documented price of the apartment. As such, these charges can run into lakhs of rupees. Family property partition and gifting of land to immediate family members does not incur any charges. Most of the states have 1% as registration charges.

While stamp duty is levied by the state governments on the market value of the property, registration value is levied for registration of documents under the registration act, 1908.

Stamp duty 8% of rs 50 lakh= rs 4 lakh. Both property registration fees and stamp duty charges can come up to 7% to 10% of the total property cost, depending on the state the property is in and the type of purchase. Registration charges 2% of rs 50 lakh= rs 1 lakh. He will have to pay the following charges: The registration charges for the resale of residential properties in hyderabad would be stamp duty is 4%, transfer duty is 0.5% and the registration fee is 0.5% of the market value of the property. What will be the stamp duty charges and registration fee if a homebuyer (male) is looking to buy a property (apartment/flat) in telangana of rs.

Source: adda.io

Source: adda.io

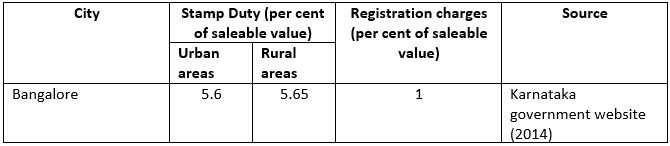

In most cities and towns in india, 1% of the property value is charged as registration fees. So, factor in these changes and save up accordingly. User charges the information provided online is updated, and no physical visit is required. The stamp duty rate will be 4% of rs. In urban areas, buyers will be paying 5.6% as stamp duty.

Source: iceet.org

Source: iceet.org

This fees is charged as a percentage of the registered value of the property and varies from state to state. In this case, the stamp duty charges will be 5 percent and registration charges will be 1 percent of the property value (46 lakhs). So, factor in these changes and save up accordingly. Fair value of the property: Most of.

Source: beijingesc.com

Source: beijingesc.com

User charges the information provided online is updated, and no physical visit is required. So, factor in these changes and save up accordingly. To avoid any shortfall in funds when buying your home and registering the property in your name, ensure that you also requisition for the stamp duty and registration charges when you apply for the home loan amount..

Source: ocregister.com

Source: ocregister.com

While stamp duty is paid to transfer the property to your name, registration charges are paid as per the registration act, 1908, to the government to maintain it in its registry. Apart from these charges, you will be charged cess and a nominal surcharge. Registration charges tend to be 1% of the property’s market value. Registration charges is 0.5% of.

Source: slideshare.net

Source: slideshare.net

So, factor in these changes and save up accordingly. Suppose gokul bought a property in chennai that has a guideline value of rs 40 lakhs. The undivided share and the apartment can be. The latest proposal aims to reduce stamp duty charges to 3% from 5% for apartments ranging between rs.35 lakh to rs.45 lakh in value. Ready reckoner rate.

Source: dailyasianage.com

Source: dailyasianage.com

Registration charges tend to be 1% of the property’s market value. Hence, registration for commercial land is also more than that of residential. The property�s stamp duty is rs.1,60,000 (4 percent of the market value rs.40,00,000) the property�s registration fee is rs.20,000 (0.5 percent of the saleable value of rs.40,00,000). User charges the information provided online is updated, and no.

Source: pinterest.com

Source: pinterest.com

Generally, 1% of the property’s total market value is charged as the registration charge. And, the transfer duty is 1.5% of the property value. The location has a great effect on the registration fees as well as the stamp duty charges. 4% of rs 40 lakhs = rs 1,60,000; In maharashtra, the registration charges are fixed, which are rs.

Source: vislab-us.net

Source: vislab-us.net

The latest proposal aims to reduce stamp duty charges to 3% from 5% for apartments ranging between rs.35 lakh to rs.45 lakh in value. Rs.1,80,000 (rs.1,60,000 + rs.20,000) is the total registration and stamp fee. The property�s stamp duty is rs.1,60,000 (4 percent of the market value rs.40,00,000) the property�s registration fee is rs.20,000 (0.5 percent of the saleable value.

According to the amendment, the stamp duty is 5%, the registration fee is 1%, the transfer fee is 1.5% of the market value of property. Registration charges is 0.5% of the property value. On the issuance of gifts to family members, stamp duty is 2%, registration charges are 0.5% (subject to minimum of rs 1000 to maximum rs 10000 fee),.

Source: nobroker.in

Source: nobroker.in

In the case of rural areas, a home buyer pays 5.65% as the stamp duty, because the surcharge is 3%. Fair value of the property: 4% stamp duty will be charged on the guidance value of the property (considering it is a municipal property) registration charge 0.5% of the saleable value. There will be a 10% cess along with 2%.

Source: blog.apnacomplex.com

Source: blog.apnacomplex.com

Apartment buyers who hitherto registered only the undivided share of the land (uds) have to henceforth register their construction agreement too and pay two per cent additional charges towards it. The undivided share and the apartment can be. The prescribed rates of registration fees are as follows: Anyway, stamp duty and registration charges are normally excluded from the home loan.

Source: adda.io

Source: adda.io

Fair value of the property= rs 50 lakh. Most of the states have 1% as registration charges. Registration charge for a resale property The registration charges will be 1% of rs.10,00,000 = rs. This fees is charged as a percentage of the registered value of the property and varies from state to state.

Source: apartmentpost.blogspot.com

Source: apartmentpost.blogspot.com

Ready reckoner rate is the minimum value of the property that is fixed by the state government. Both property registration fees and stamp duty charges can come up to 7% to 10% of the total property cost, depending on the state the property is in and the type of purchase. Only undivided share of property to attract stamp duty, registration.

Source: stay.greatworld.com.sg

Source: stay.greatworld.com.sg

Most of the states have 1% as registration charges. The location has a great effect on the registration fees as well as the stamp duty charges. Only undivided share of property to attract stamp duty, registration charges; What will be the stamp duty charges and registration fee if a homebuyer (male) is looking to buy a property (apartment/flat) in telangana.

Source: icacmp2016.weebly.com

Source: icacmp2016.weebly.com

The charges are different in different states and they also differ in accordance with the neighboring area being urban or rural. Registration charges 2% of rs 50 lakh= rs 1 lakh. So, factor in these changes and save up accordingly. Everyone must pay the stamp duty and registration charges at the time of beheading of a transfer agreement such as.

Source: adda.io

Source: adda.io

As such, these charges can run into lakhs of rupees. And, stamp duty is calculated as the higher of ready reckoner rate or actual transaction value. The location has a great effect on the registration fees as well as the stamp duty charges. In this case, the stamp duty charges will be 5 percent and registration charges will be 1.

Source: apartmentpost.blogspot.com

Source: apartmentpost.blogspot.com

Stamp duty 8% of rs 50 lakh= rs 4 lakh. This is an absolute killer as far as buying a property is concerned. The undivided share and the apartment can be. There will be a 10% cess along with 2% surcharge on stamp duty as an additional cost. Generally, 1% of the property’s total market value is charged as the.

Suppose gokul bought a property in chennai that has a guideline value of rs 40 lakhs. So, factor in these changes and save up accordingly. Hyderabad is one of the most active residential markets in recent times. To avoid any shortfall in funds when buying your home and registering the property in your name, ensure that you also requisition for.

Source: pinterest.com

Source: pinterest.com

Suppose gokul bought a property in chennai that has a guideline value of rs 40 lakhs. In urban areas, buyers will be paying 5.6% as stamp duty while areas under village panchayats will have a 3% surcharge and total stamp duty values of 5.65%. Hi prajwal, the stamp duty and registration charges will be levied according to the documented price.

Source: procapitusrealty.in

Source: procapitusrealty.in

According to the amendment, the stamp duty is 5%, the registration fee is 1%, the transfer fee is 1.5% of the market value of property. Registration charges is 0.5% of the property value. In urban areas, buyers will be paying 5.6% as stamp duty while areas under village panchayats will have a 3% surcharge and total stamp duty values of.

Source: apartmentpost.blogspot.com

Source: apartmentpost.blogspot.com

Both property registration fees and stamp duty charges can come up to 7% to 10% of the total property cost, depending on the state the property is in and the type of purchase. Generally, in kerala, the stamp duty stands at 8% and the registration fee is 2%. And, the transfer duty is 1.5% of the property value. This must.

Source: commonfloor.com

Source: commonfloor.com

The property�s stamp duty is rs.1,60,000 (4 percent of the market value rs.40,00,000) the property�s registration fee is rs.20,000 (0.5 percent of the saleable value of rs.40,00,000). He will have to pay the following charges: Everyone must pay the stamp duty and registration charges at the time of beheading of a transfer agreement such as sale deed between two parties..

Source: nwitimes.com

Source: nwitimes.com

There will be a 10% cess along with 2% surcharge on stamp duty as an additional cost. Registration charge for a resale property Rs.1,80,000 (rs.1,60,000 + rs.20,000) is the total registration and stamp fee. The location has a great effect on the registration fees as well as the stamp duty charges. In this case, the stamp duty charges will be.

Source: blog.apnacomplex.com

Source: blog.apnacomplex.com

A is buying an apartment worth rs 80 lakh, then the applicable stamp duty is five percent, registration charge is 0.5 percent, and transfer duty is 1.5 percent. The undivided share and the apartment can be. While stamp duty is levied by the state governments on the market value of the property, registration value is levied for registration of documents.

Source: apartmentpost.blogspot.com

Source: apartmentpost.blogspot.com

The stamp duty and registration charges in delhi are calculated on the actual value of the house property. In the case of rural areas, a home buyer pays 5.65% as the stamp duty, because the surcharge is 3%. 4% stamp duty will be charged on the guidance value of the property (considering it is a municipal property) registration charge 0.5%.