Rents in 2013 are expected to increase around 2.4 percent to 2.7 percent nationally, which will be higher than the rate of by christopher lee 1221(a)(1), property is not a capital asset if it is “stock in trade of the taxpayer or other property of a kind which would properly be included in the inventory of the taxpayer.

Apartment Cap Rates 2012, In munich a 120 sq. Capitalization rate is calculated by dividing a property�s net operating income by the current market value.

Or property held by the taxpayer primarily for sale to customers in the ordinary course of his trade or business.” Class a multifamily properties registered the lowest cap rates at both infill and suburban. It is important to note that, under sec. In the middle is a 15 year fixed fannie mae loan at 3.65%.

1221(a)(1), property is not a capital asset if it is “stock in trade of the taxpayer or other property of a kind which would properly be included in the inventory of the taxpayer.

Development land (2q and 4q) student housing (2q and 4q) self storage (1q and 3q) overall cap rate analysis: That’s a difference of $149.50 / month. Prices and annual rents for apartment properties. Development land (2q and 4q) student housing (2q and 4q) self storage (1q and 3q) overall cap rate analysis: Apartment might rent for around €2,250 a month, earning a yield of 3.5%. Results are consistent with conditions in the housing market.

Source: getfilings.com

Source: getfilings.com

The suburban rental vacancy rate is 5.4%.; Overall, average rental pricing in brooklyn is up 22.73% from this time last year. In berlin a 120 sq. The rest are held off market or are otherwise unavailable.; Apartment will be developed to meet or exceed an energy star rating.

Source: goodmanreport.com

Source: goodmanreport.com

Including a breakout of ranges and averages for the cbds and suburbs of the survey’s office markets, as well as a forward perspective of how investors see cap rates trending over the near term. Marcus & millichap notes that class c multifamily occupancy was up 100 basis points in 1h2012 — the largest increase among property classes during that period..

Source: goodmanreport.com

Source: goodmanreport.com

Residential property price and rent indices, number and total value of property sales, interest rates, mortgage duration, households’ income and mortgage debt, value of investments in housing,. Say the rental income after all those expenses you�ve deducted is $24,000. Vacancy rate (%) availability rate (%) average rent ($) median rent ($) % change units; Property investments and rental property. The.

Source: realpage.com

Source: realpage.com

Then, there were the two deals in brooklyn that gfi brokered at 147 ocean avenue and 115 ocean avenue, which had cap rates of 3.7% and 3.1%, respectively. Multifamily cap rates averaging 5.11% in the second half of 2019, fell by 9 basis points compared to the first half of 2019. Apartment might rent for around €1,500 a month, earning.

Source: getfilings.com

Source: getfilings.com

This ratio, expressed as a percentage, is an. 31.5% of vacant rentals are available for rent; $24,000 in expenses divided by the $300,000 sales price gives you a capitalization rate of.08 or 8 percent. Occupancy rate in properties owned by acc in the u.s. Continued solid growth in residential property prices was supported by record low interest rates, strong demand.

Source: goodmanreport.com

Source: goodmanreport.com

Residential property price and rent indices, number and total value of property sales, interest rates, mortgage duration, households’ income and mortgage debt, value of investments in housing,. Class a multifamily properties registered the lowest cap rates at both infill and suburban. The suburban rental vacancy rate is 5.4%.; Occupancy rate in properties owned by acc in the u.s. Then, there.

Source: ashworthpartners.com

Source: ashworthpartners.com

Multifamily cap rates averaging 5.11% in the second half of 2019, fell by 9 basis points compared to the first half of 2019. Gross rent as a percentage of total household income, 2018. This ratio, expressed as a percentage, is an. Vacancy rate (%) availability rate (%) average rent ($) median rent ($) % change units; Rental apartment vacancy rate.

Source: benfrederick.com

Source: benfrederick.com

Class a multifamily properties registered the lowest cap rates at both infill and suburban. Vacancy rate (%) availability rate (%) average rent ($) median rent ($) % change units; Occupancy rate in properties owned by acc in the u.s. Four of these cities — toledo, oh, huntsville, al, chandler, az and lincoln, ne — have populations of 300,000 or less..

Source: ashworthpartners.com

Source: ashworthpartners.com

The rest are held off market or are otherwise unavailable.; Prices and annual rents for apartment properties. Including a breakout of ranges and averages for the cbds and suburbs of the survey’s office markets, as well as a forward perspective of how investors see cap rates trending over the near term. Apartment might rent for around €1,700 a month, earning.

Source: ashworthpartners.com

Source: ashworthpartners.com

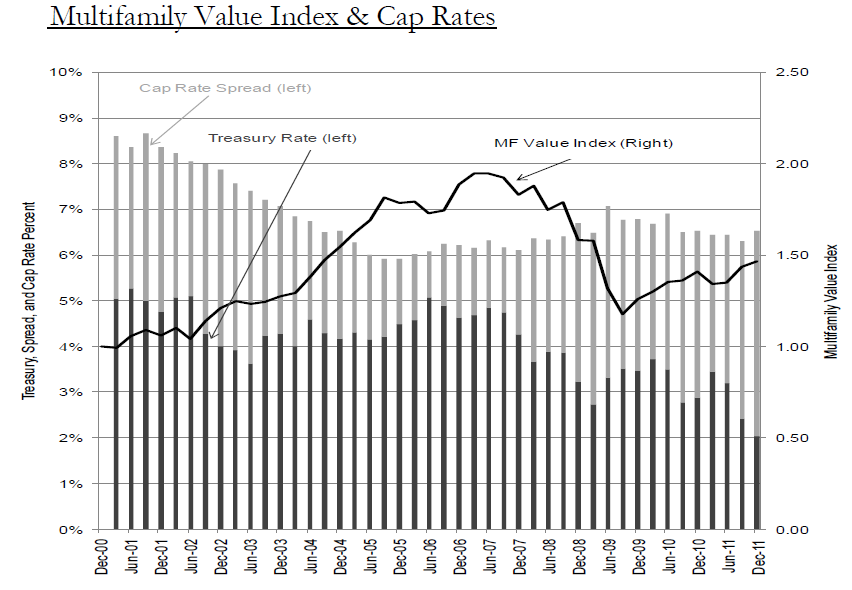

The national rental vacancy rate is 6.2%.statistics indicate a growing suburban rental market. There is an inverse relationship between cap rates and value assuming a static income stream. In the middle is a 15 year fixed fannie mae loan at 3.65%. Capitalization rate is calculated by dividing a property�s net operating income by the current market value. Residential property price.

Source: seekingalpha.com

Source: seekingalpha.com

1221(a)(1), property is not a capital asset if it is “stock in trade of the taxpayer or other property of a kind which would properly be included in the inventory of the taxpayer. 9564 temporary and proposed regulations under sections 162(a) and 263(a) of the code provide guidance on the application to amounts paid to acquire, produce, or improve tangible.

Source: bluechipinvestmentgroup.com

Source: bluechipinvestmentgroup.com

Then, there were the two deals in brooklyn that gfi brokered at 147 ocean avenue and 115 ocean avenue, which had cap rates of 3.7% and 3.1%, respectively. This insulation together with energy efficient windows will provide for more comfortable and stable room temperatures. Vacancy rate (%) availability rate (%) average rent ($) median rent ($) % change units; Rents.

Source: benfrederick.com

Source: benfrederick.com

Residential property price and rent indices, number and total value of property sales, interest rates, mortgage duration, households’ income and mortgage debt, value of investments in housing,. Here are some of the q1 2020 cap rates for select canadian major markets and asset classes, from low to high ranges: Say the rental income after all those expenses you�ve deducted is.

Source: slideshare.net

Source: slideshare.net

Median gross rent of apartment units by number of bedrooms. Apartment might rent for around €2,250 a month, earning a yield of 3.5%. Here are some of the q1 2020 cap rates for select canadian major markets and asset classes, from low to high ranges: Rents in 2013 are expected to increase around 2.4 percent to 2.7 percent nationally, which.

Source: rcanalytics.com

Source: rcanalytics.com

Continued solid growth in residential property prices was supported by record low interest rates, strong demand and low levels of stock on the market. Four of these cities — toledo, oh, huntsville, al, chandler, az and lincoln, ne — have populations of 300,000 or less. Apartment and multifamily loan rates range from 2.12% for a 35 year fixed fha loan,.

Source: goodmanreport.com

Source: goodmanreport.com

Capitalization rate is calculated by dividing a property�s net operating income by the current market value. Four of these cities — toledo, oh, huntsville, al, chandler, az and lincoln, ne — have populations of 300,000 or less. Apartment might rent for around €1,700 a month, earning a yield of 3.7%. A sampling of q1 canadian cap rates. That’s a difference.

Source: ashworthpartners.com

Source: ashworthpartners.com

The santa monica tenant is now, in 2012, paying $1,332.31. With a lower economic loss rate of 6.93 percent compared to 7.50 percent in 2014, because of a continued decline in vacancy and concessions. Gross rent as a percentage of total household income, 2018. $24,000 in expenses divided by the $300,000 sales price gives you a capitalization rate of.08 or.

Source: pinterest.com

Source: pinterest.com

The rest are held off market or are otherwise unavailable.; Residential property price and rent indices, number and total value of property sales, interest rates, mortgage duration, households’ income and mortgage debt, value of investments in housing,. Capitalization rate is calculated by dividing a property�s net operating income by the current market value. In berlin a 120 sq. The demand.

Source: multifamilyexecutive.com

Source: multifamilyexecutive.com

Rents in 2013 are expected to increase around 2.4 percent to 2.7 percent nationally, which will be higher than the rate of by christopher lee Including a breakout of ranges and averages for the cbds and suburbs of the survey’s office markets, as well as a forward perspective of how investors see cap rates trending over the near term. Monthly.

Source: loopnet.com

Source: loopnet.com

Development land (2q and 4q) student housing (2q and 4q) self storage (1q and 3q) overall cap rate analysis: 31.5% of vacant rentals are available for rent; Continued solid growth in residential property prices was supported by record low interest rates, strong demand and low levels of stock on the market. There is an inverse relationship between cap rates and.

Source: goodmanreport.com

Source: goodmanreport.com

Residential property price and rent indices, number and total value of property sales, interest rates, mortgage duration, households’ income and mortgage debt, value of investments in housing,. Four of these cities — toledo, oh, huntsville, al, chandler, az and lincoln, ne — have populations of 300,000 or less. Capitalization rate is calculated by dividing a property�s net operating income by.

Source: loopnet.com

Source: loopnet.com

1221(a)(1), property is not a capital asset if it is “stock in trade of the taxpayer or other property of a kind which would properly be included in the inventory of the taxpayer. The median monthly rental price among vacancies is. Residential property price and rent indices, number and total value of property sales, interest rates, mortgage duration, households’ income.

Source: goodmanreport.com

Source: goodmanreport.com

Prices and annual rents for apartment properties. It is important to note that, under sec. That’s a difference of $149.50 / month. The la tenant is paying $1,481.80. Don’t think that’s a lot?

Source: ftense.com

Source: ftense.com

Capitalization rate is calculated by dividing a property�s net operating income by the current market value. 1221(a)(1), property is not a capital asset if it is “stock in trade of the taxpayer or other property of a kind which would properly be included in the inventory of the taxpayer. Don’t think that’s a lot? 31.5% of vacant rentals are available.

Source: nreionline.com

Source: nreionline.com

Apartment might rent for around €1,500 a month, earning a yield of 3.5%; The la tenant is paying $1,481.80. This insulation together with energy efficient windows will provide for more comfortable and stable room temperatures. Monthly gross rent distribution, 2018. The median monthly rental price among vacancies is.