We provide cap rates, gross rent multipliers and expense comparables for properties in salt lake city, west valley city, provo, west jordan, orem, sandy, ogden, st. This initial comparison favors the second property.

Apartment Cap Rates 2017, Percent of habitable housing that is unoccupied, excluding properties that are for seasonal, recreational, or occasional use: Cap rates across canadian markets 2017 q3 subtle shift in outlook for tomorrow’s markets.

Higher quality apartments in the larger communities (such as fargo, mankato, st. George and many other cities in the state. Real capital analytics inc., www.rcanalytics.com. In the example, the 8.4% cap rate is the personal cap rate on a $1 million investment.

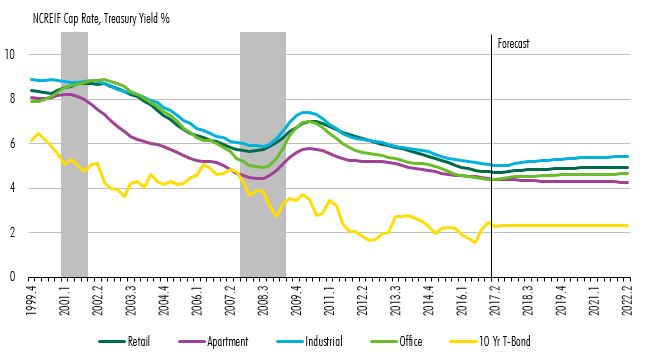

Whereas equivalent private market deals are still pricing in the ~4% range.

It by the selling price to get the cap rate. Generally speaking, neighborhoods with high appreciation rates have lower cap rates. Condo and apartment cap rates by city range: Percent of occupied housing units occupied by renters: Apartment and multifamily loan rates range from 2.12% for a 35 year fixed fha loan, to 3.79% for a 5 year fixed community bank loan. From 2.40% to 9.81% highest condo and apartment cap rate:

Source: rootrealty.com

Source: rootrealty.com

But if the market cap rate is 6.35%, then the full value is indeed $1,344,832. Average price per square foot increased by 9.8% and average price per unit increased by 5.8% over the trailing twelve months (ttm) february 2018 vs. Cloud saw a few larger, newer properties trade with cap rates below 6.0%. Last year, the compression resulted in cap.

Source: seekingalpha.com

Source: seekingalpha.com

Cap rates will be higher or lower for individual properties depending upon the size, class and location of the property within the msa. But if the market cap rate is 6.35%, then the full value is indeed $1,344,832. What challenges or growth opportunities do you see for 2017? Finally, cap rates for class c properties saw even more compression and.

Source: blog.victoriacommercialrealestate.com

Source: blog.victoriacommercialrealestate.com

Percent of occupied housing units occupied by renters: Cap rates will be higher or lower for individual properties depending upon the size, class and location of the property within the msa. Auburn real estate market, 9.81% lowest condo and apartment cap rate: Cap rates are down about 50 to 75 basis points from 2014/2015. 2) market cap rate based on.

Source: rcanalytics.com

Source: rcanalytics.com

Generally speaking, neighborhoods with high appreciation rates have lower cap rates. Equity irr with upside performance. Buyers of large complexes realize the value and begin to buy in a large way (see sales by unit count, page 15.) new record in terms of total gross transaction dollars sold of $1.113b. Centersquare’s reit cap rate perspective presents the market pricing of.

Source: rpcpropertytax.com

Source: rpcpropertytax.com

Cap rates for the fourth quarter of 2017 were between 5.7 and 6.9 percent, with suburban office and warehouse recording the highest rates. From 2.40% to 9.81% highest condo and apartment cap rate: Condo and apartment cap rates by city range: Cap rates across canadian markets 2017 q3 subtle shift in outlook for tomorrow’s markets. Current cap rates for apartments.

Source: reit.com

From 2.40% to 9.81% highest condo and apartment cap rate: Apartments apartments</strong> >200 units 5.75 6.00 6.25 6.75 7.00 7.25 7.75 8.00 8.75 9.75 10.50 10.75 11.25 11.50 11.75. Average price per square foot increased by 9.8% and average price per unit increased by 5.8% over the trailing twelve months (ttm) february 2018 vs. Real capital analytics inc., www.rcanalytics.com. Condo.

Source: forbes.com

Source: forbes.com

In the example, the 8.4% cap rate is the personal cap rate on a $1 million investment. The same period in 2017. “lower vacancy rates and accelerating rental growth will support apartment income. 2q 2016 total * share component 2q 2016 1q 2016 1 year office 1,398 $186.67 36.9% income 1.15% 1.12% 4.63% appreciation 0.59% 0.59% 4.52% In the middle.

Source: landlordo.com

Source: landlordo.com

Cap rates for stabilized class b range from about 5.5% to 6.25%. Cbre is pleased to present its semiannual north america cap rate survey for h1 2017, which reveals cap rates and pricing trends for all major property types in major markets across the u.s. Equity irr with upside performance. Cap rates across canadian markets 2017 q3 subtle shift in.

Source: guggenheimpartners.com

Source: guggenheimpartners.com

Percent of occupied housing units occupied by renters: What challenges or growth opportunities do you see for 2017? The higher a property’s risk, the 5/12/2017 17 pwc re investor survey cap rate trend data. Cap rates will be higher or lower for individual properties depending upon the size, class and location of the property within the msa.

Source: blog.victoriacommercialrealestate.com

Source: blog.victoriacommercialrealestate.com

Auburn real estate market, 9.81% lowest condo and apartment cap rate: A lower (higher) cap rate would imply a higher (lower) property value; This spread is a compelling arbitrage opportunity for multifamily investors that want to put capital to work but keep coming in 27th place on austin apartment auctions (aka marketed deals). Percent of occupied housing units occupied by.

Source: rcanalytics.com

Source: rcanalytics.com

Buyers of large complexes realize the value and begin to buy in a large way (see sales by unit count, page 15.) new record in terms of total gross transaction dollars sold of $1.113b. This initial comparison favors the second property. 2017 american community survey 5. Centersquare’s reit cap rate perspective presents the market pricing of $1.5 trillion of real.

In the middle is a 15 year fixed fannie mae loan at 3.65%. 5/12/2017 17 pwc re investor survey cap rate trend data. Equity irr with downside performance. Apartment high rise 3.50% 4.25% q 2.50% 3.00% tu 5.00% 5.50% tu. From 2.40% to 9.81% highest condo and apartment cap rate:

Apartments apartments</strong> >200 units 5.75 6.00 6.25 6.75 7.00 7.25 7.75 8.00 8.75 9.75 10.50 10.75 11.25 11.50 11.75. George and many other cities in the state. Cbre is pleased to present its semiannual north america cap rate survey for h1 2017, which reveals cap rates and pricing trends for all major property types in major markets across the u.s..

Source: realtytimes.com

Source: realtytimes.com

Cbre is pleased to present its semiannual north america cap rate survey for h1 2017, which reveals cap rates and pricing trends for all major property types in major markets across the u.s. So if a property has a annual net income of $100,000 and it sold for 1 million dollars, it has a cap rate of 10. Generally speaking,.

Source: altusgroup.com

Source: altusgroup.com

Property investments and rental property. So if a property has a annual net income of $100,000 and it sold for 1 million dollars, it has a cap rate of 10. Cbre is pleased to present its semiannual north america cap rate survey for h1 2017, which reveals cap rates and pricing trends for all major property types in major markets.

Source: globest.com

Source: globest.com

So if a property has a annual net income of $100,000 and it sold for 1 million dollars, it has a cap rate of 10. Cap rates across canadian markets 2017 q3 subtle shift in outlook for tomorrow’s markets. Cloud, etc.) are in the approximate range of 6.25% to 7.00%. It by the selling price to get the cap rate..

Source: wp.millionairepossibilities.com

Source: wp.millionairepossibilities.com

Property investments and rental property. Current cap rates for apartments in the 50 largest multifamily markets the list below shows median cap rates for the entire metropolitan statistical area (msa) for select property types. Cap rates will be higher or lower for individual properties depending upon the size, class and location of the property within the msa. Real capital analytics.

Source: wealthmanagement.com

Source: wealthmanagement.com

But if the market cap rate is 6.35%, then the full value is indeed $1,344,832. Current cap rates for apartments in the 50 largest multifamily markets the list below shows median cap rates for the entire metropolitan statistical area (msa) for select property types. Percent of occupied housing units occupied by renters: One has a cap rate of 8%, while.

Source: seekingalpha.com

Source: seekingalpha.com

George and many other cities in the state. Buyers of large complexes realize the value and begin to buy in a large way (see sales by unit count, page 15.) new record in terms of total gross transaction dollars sold of $1.113b. A lower (higher) cap rate would imply a higher (lower) property value; Flow cap rate, cap (c1), is.

Source: blog.victoriacommercialrealestate.com

Source: blog.victoriacommercialrealestate.com

Cloud saw a few larger, newer properties trade with cap rates below 6.0%. Cbre is pleased to present its semiannual north america cap rate survey for h1 2017, which reveals cap rates and pricing trends for all major property types in major markets across the u.s. Generally speaking, neighborhoods with high appreciation rates have lower cap rates. Auburn real estate.

Source: seekingalpha.com

Source: seekingalpha.com

What challenges or growth opportunities do you see for 2017? In the u.s., cap rates for office, retail and hotel assets inched up in h1, while those for industrial and multifamily assets fell slightly. There is an inverse relationship between cap rates and value assuming a static income stream. This spread is a compelling arbitrage opportunity for multifamily investors that.

Source: commercialsearch.com

Source: commercialsearch.com

5/12/2017 17 pwc re investor survey cap rate trend data. Apartments apartments</strong> >200 units 5.75 6.00 6.25 6.75 7.00 7.25 7.75 8.00 8.75 9.75 10.50 10.75 11.25 11.50 11.75. 2) market cap rate based on the average cap rates for local investors. “lower vacancy rates and accelerating rental growth will support apartment income. Buyers of large complexes realize the value.

Source: dc.curbed.com

Source: dc.curbed.com

One has a cap rate of 8%, while the other has a cap rate of 13%. Cloud saw a few larger, newer properties trade with cap rates below 6.0%. Centersquare’s reit cap rate perspective presents the market pricing of $1.5 trillion of real estate in the u.s. But if the market cap rate is 6.35%, then the full value is.

Source: cbre-ea.com

Source: cbre-ea.com

The same period in 2017. For example, if the appropriate cap rate for an office building producing an annual noi of $1 million is 10%, then the estimated value of the property is $10 million. But if the market cap rate is 6.35%, then the full value is indeed $1,344,832. A lower (higher) cap rate would imply a higher (lower).

Source: steppcommercial.com

Source: steppcommercial.com

But if the market cap rate is 6.35%, then the full value is indeed $1,344,832. Cap rates across canadian markets 2017 q3 subtle shift in outlook for tomorrow’s markets. In the example, the 8.4% cap rate is the personal cap rate on a $1 million investment. 2) market cap rate based on the average cap rates for local investors. Cap.